It is an easy, secure, quick and convenient way to send or receive money. Recipients are notified by email and/or text message and must login to their online banking to accept the transfer.

Internet Banking

Electronic Money Management. It’s easy with Southwest!

With our Internet Banking, you can perform all of your day-to-day transactions any time and virtually anywhere, using a personal computer with Internet access.

Pay bills, get account information, transfer funds, make investment and credit card inquiries – it’s all online anytime with MemberDIRECT® internet banking.

MemberDIRECT® is easy to use, safe and secure, and available to you 24 hours a day, seven days a week. To get your Access Code, just visit your nearest branch of Southwest Regional Credit Union.

What is Interac® e-Transfer?

Interac e-Transfer, formerly known as Interac Email Money Transfer (EMT), is a fast, secure, and convenient way for anyone with an email address or a mobile phone number and a Canadian bank account to send and receive money. The sender does not need to know the recipient’s institution or account information. Recipients are notified by email and/or text message when a transfer has been sent, and participating financial institutions transfer the funds using established and secure banking procedures.

Features

The ease of sending money to anyone with an email address has made Interac e-Transfer the trusted money transfer service adopted by Canadians. The most recent enhancements provide customers with the increased flexibility and convenience of transferring money on a mobile web-enabled phone.

With Interac e-Transfer, all the following features are available on both the desktop and mobile web.

- Send money

- Receive money

- Send email notification

- Send text message notification (New)

- Create recipient instantly

- View and manage pending transfers

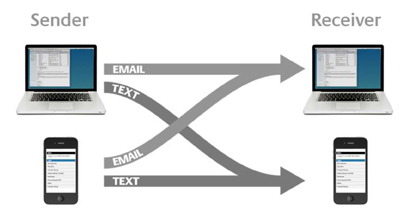

Interac e-Transfer can be sent or received through email using a full-sized website on a desktop or laptop computer, or through email and text message using a mobile browser on a smartphone.

Sending an Interac e-Transfer

Sandra wishes to send $100 as a birthday present to her brother Ryan. She logs into online banking on her desktop computer and chooses to send an Interac e-Transfer of $100 to Ryan. Since Ryan is busy and always travelling, Sandra chooses to send the transfer notification through both email and text message. This way Ryan can choose to accept the transfer on his laptop or on his smartphone. Sandra could also have used her smartphone to send the transfer using the Mobile Web version of online banking.

Receiving an Interac e-Transfer

Ryan is travelling as usual, and is waiting for a train. He receives a text message and is pleased to see it is an Interac e-Transfer of $100, a birthday present from his sister Sandra. Ryan clicks on the link within the text message and opens a mobile web browser on his phone. Using the convenient mobile web interface, he logs into his credit union’s online banking mobile site and quickly accepts the transfer.

Ryan could have also accepted the transfer through email on his smartphone, or through email on a desktop or laptop computer.

Interac e-Transfer Instructions

Sending an Interac e-Transfer: Step-by-Step

- Login to your online banking

- Create a profile with your email address and/or mobile phone number, if you have not already done so

- Select 'Send Interac e-Transfer' under 'Transfers'

- Select a recipient, or add a new recipient profile, by entering the person's name or business name, plus an email address and/or mobile number

- Choose if the recipient will receive an email and/or text message

- Create a security question and answer that only you and the recipient know

- Add a personal message (optional) but don't include the answer to the security question

- Select an account from which to make the transfer and enter the amount

- Send the Interac e-Transfer (your account will be debited the transfer amount immediately, plus any applicable fees)

- If a Delegate is initiating the Interac e-Transfer, the Signer must also approve the transaction in the 'Transaction Manager' section of online banking before the transfer can be sent

- If the Interac e-Transfer is being initiated from a Dual Signature account, both signers must approve the transfer in the 'Transaction Manager' section of online banking before the transfer can be sent

Within approximately 30 minutes, the recipient will be notified that the payment has been made.

Receiving an Interac e-Transfer: Step-by-Step

- Ensure the link received via email or text message offers a secure connection that takes you to a site with the 'https' prefix, rather than 'http'

- Click on the link and you'll be taken to a secure Interac website

- Follow the instructions on the site to select Southwest Regional Credit Union and click 'Deposit', and you'll be redirected to our online banking login screen

- Login to answer the security question and accept the transfer

- Select the account where you wish to deposit the money

Frequently Asked Questions

What is an Interac® e-Transfer?

Who can use Interac e-Transfer?

Any individual or small business owner with an account at a Canadian financial institution that offers the service can initiate an e-Transfer, while anyone with an account at a Canadian financial institution can receive one.

Is it safe to transfer money by email or text message?

Actually, there is no money attached to emails or text messages. Instead, financial institutions use standard practices for safe money transfers.

Is there a charge for sending an Interac e-Transfer?

Yes, Southwest Regional Credit Union has a Flat fee of $1.00 per e-Transfer, unless included in an account package.

Are there limits on how much can be sent or received?

While there are no minimums – you can send any amount above $0 – there are maximums for both sending and receiving Interac e-Transfers.

Receiving - Maximum Transaction up to $25,000

Sending - Daily Maximum Transactions up to $3,000

Sending - Weekly Maximum Transactions up to $10,000

Sending - Monthly Maximum Transactions up to $20,000

Is there a fee to cancel an Interac e-Transfer?

There are no cancellation fees, however, the sending fee is non-refundable. If you cancel an e-Transfer, your account will be credited with the dollar amount of the transfer minus the sending fee.

Is there a fee to receive an Interac e-Transfer?

As long as your financial institution offers the service and you use online banking, it's free to receive an Interac e-Transfer.

What happens when a recipient's financial institution doesn't offer this service?

Recipients can still receive the money by registering with Interac and providing their banking information. The deposit usually takes four to six business days and Interac charges a $4.00 administration fee, which is deducted from the total amount of the transfer.

What if I don't bank online, can I still deposit an Interac e-Transfer?

Yes, provided you have an account at a Canadian financial institution. However, you'll have to register with Interac and provide your banking information. The deposit usually takes four to six business days and Interac charges a $4.00 administration fee, which is deducted from the total amount of the transfer.

Why do text-message notifications come from 100001?

This is the short code from which all Interac e-Transfer text notifications are sent.

Can I send an Interac e-Transfer to a landline?

If you provide only a landline as the way to notify a recipient, you'll be informed that the transfer could not be completed. You'll need to provide new contact information – either a mobile phone number or email. If, however, you provide a landline and an email, the recipient will be notified via email.

Can I send an Interac e-Transfer to anyone?

No. In order to send and/or receive Interac e-Transfers, both senders and recipients must have accounts at Canadian financial institutions. The transfer must also be in Canadian dollars.

How long does it take to receive the money?

For recipients, it takes approximately 30 minutes for notifications to be received. As soon as the notification is received, the recipient can deposit the money. As a sender, the money is debited from your account immediately after finalizing the transfer.

What happens if I use an incorrect mobile phone number?

The notification will be sent to that phone number, however, that person will not be able to deposit the transfer because s/he won't know the answer to the security question. Recipients must correctly answer a security question before they can deposit the money.

Can I cancel an Interac e-Transfer?

You can cancel the transfer anytime until the recipient accepts it. Generally, it takes 30 minutes for notifications to be sent to recipients. To cancel a transfer, click on the 'Cancel' link beside the list of pending transfers.

If a transfer hasn't been accepted within 30 days, it will automatically expire and the sender will be notified. The sender can either click on the 'Cancel' link beside the list of pending transfers or let Interac cancel the transaction. Money will be returned to the sender within seven days of cancelling the transaction, however, fees charged at the time of sending the transfer are not reimbursable.

You can also send reminders to recipients who have yet to accept transfers by clicking on the 'Resend Notice' link beside the list of pending transfers.

What happens if the recipient rejects the transfer?

In that case, you'll be notified and prompted to login to your online banking to cancel the pending transfer.